Profits tax will be levied on profits derived from any business operating in Hong Kong. Every April, all companies in Hong Kong will receive tax returns issued by the Inland Revenue Department (IRD). Overdue submissions will result in high fines! This article will talk about what you should know about the 3 types of profits tax. 3 tips for filing corporate tax will be shared as well. To make tax matters easier, be sure to keep reading!

What is Profits Tax?

Any person, partnership, corporation or trustee who generates assessable profits from carrying on trades, profession or businesses in Hong Kong is required to pay profits tax, but profits arising from the sale of capital assets are excluded. If non-residents or self-employed persons derive profits from Hong Kong, they are also taxed on their income.

Hong Kong profits tax has a two-tiered system, thus loosening the financial stress of enterprises. The profits tax rate for assessable profits* up to the first HK$2 million for limited companies is 8.35%, and 7.5% for unlimited companies.

For any part of assessable profits over HK$2 million, the rate for limited companies is 16.5%, and 15% for unlimited companies.

* Assessable Profits (or adjusted losses) refer to the net profits (or losses suffered) of any person arising in or derived from Hong Kong during the financial year.

Types of Profits Tax Return

According to IRD, there are 3 types of profits tax, which are Corporations (BIR51), Persons Other Than Corporations (BIR52), and In Respect Of Non-Resident Persons (BIR54).

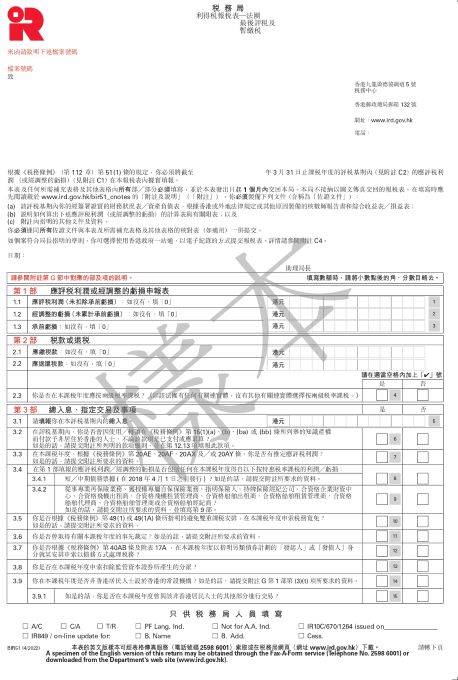

1. Corporations (BIR51)

BIR51 is applicable to companies operating in Hong Kong. Entrepreneurs should be aware that new rule has been implemented by the IRD in 2023, in which small businesses and dormant companies ARE REQUIRED to submit all supporting documents along with BIR51, such as audited financial statements with the profit tax computations.

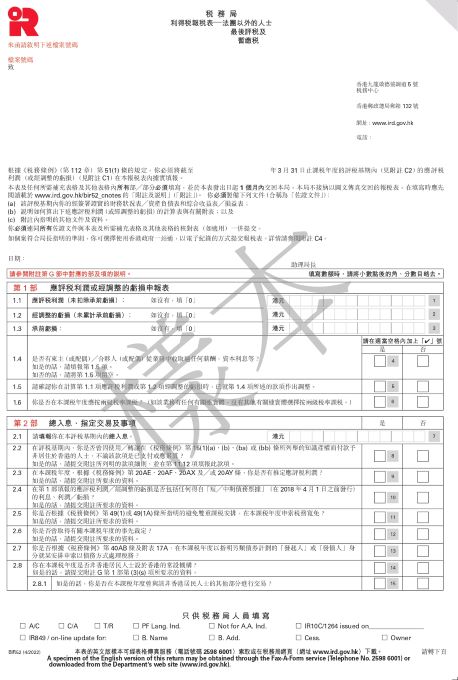

2. Persons Other Than Corporations (BIR52)

BIR52 is applicable to the businesses carried on by partnership in Hong Kong. If the sole proprietorship is converted into a partnership business or vice versa within a financial year, the profit and loss for the entire year must be reported in BIR52 (not Part 5 of BIR60). If financial statements are recorded in foreign currency, the person completing the form should settle the annual average exchange rate and report the amount in Hong Kong dollars.

3. In Respect Of Non-Resident Persons (BIR54)

BIR54 is applicable to non-residents with taxable income carrying on business, trade or profession in Hong Kong, i.e. persons without permanent business presence in Hong Kong. If a Hong Kong resident establishes an offshore company in a foreign country, it does not fall into this category.

Notes of Filing Profits Tax Return

- In terms of submission deadlines, a newly incorporated company will receive its first profits tax return 18 months after its establishment and must submit it within 3 months. For subsequent profits tax returns, they will be issued by IRD at the beginning of April each year, and companies have to submit it within 1 month from the date printed on the tax form.

- Since 2023, all companies including dormant companies are required to prepare financial statements and other supporting documents in profits tax return.

Can I Delay the Filing of Profits Tax Return?

A company may apply for a deferral of profits tax return through a tax representative. The IRD will issue a notice to tax representatives at the beginning of each year, announcing the details of the Block Extension Scheme for the tax returns for the respective year. Besides, an extension of 2 weeks will be granted for small companies and small partnerships to file their profits tax returns through the eTAX online platform.

Are Offshore Companies Required to Pay Profits Tax?

Offshore companies are not exempted from paying profits tax, but whether they are required to pay depends on the nature and scope of the company’s business in Hong Kong, such as whether the source of profits is all generated outside Hong Kong, if the business is operated in foreign land, and whether the services or products are sold in Hong Kong. Other factors also include if there are customers or suppliers in Hong Kong, and whether commercial agreements are signed outside Hong Kong. If none of the above events takes place in Hong Kong, the company theoretically does not need to pay profits tax.

Documents Required for Company Profits Tax Return

- Completed Profits Tax Return form ” BIR51 (for limited company) / BIR52 (for partnership business)”

- *For sole proprietorship* Tax Return – Individuals (BIR60)

- Annual financial statement

- Calculation of Assessable Profits (or adjusted losses) and related appendix

- Other supporting documents

Supplementary Forms

It is common for companies to fill out supplementary forms in order to claim tax benefits. There are currently 15 supplementary forms in total, which can be downloaded from the IRD website . In addition, only supplementary forms S1, S2, S3 and S4 can be submitted electronically together with profits tax return, the remaining supplementary forms have to be submitted in paper form together with the tax return.

What If I Miss the Deadline of Profits Tax Return?

For offenders of late submission of profits tax return, or those who make incorrect statements without reasonable grounds, they can be subject to a fine of $10,000 and a further fine of treble the amount of the tax undercharged.

3 Tips to File Corporate Tax

1. Bookkeeping

Here’s what you can do for a smoother process of corporate tax return: constant bookkeeping. Companies should categorize and save all the financial documents well. There will not be sufficient time if they are arranged after the issue of tax return. Neglecting bookkeeping can cause mistakes in the financial statement. Time cost will raise by every explanation made to the auditor, the audit process is hence slowed down with a higher charge for that. If the IRD inquires about the company’s accounts, well-organized book records can speed up the response and projects a more credible image. In addition, enterprises can also employ third-party cloud accounting software to facilitate a more synchronized financial activities and records.

2. Create and Update Balance Sheet Regularly

Aside from good bookkeeping, the company should also regularly update the balance sheet to clearly show their income, expenses, assets and changes in capital ratios, so that auditors can examine various records more effectively.

3. Appoint a Tax Representative

Appointing a tax representative allows more preparation time for the company. The tax representative acts as an agent to professionally handle the cumbersome matters, and apply for an extension of tax return if needed.

OneStart Business Center has a team of certified public accounts (CPA) and business consultants offering tax and entrepreneurial support. Companies can enjoy extra perks by choosing our services and tax representatives. Feel free to call 3575 6888, or Whatsapp OneStart Business Consultants to know more!